The series continues with Part 2 and Part 3.

I. Not Your Keys, Not Your Yield

Atomic.Finance empowers users to earn a return on bitcoin without giving up private keys or personal information.

Bitcoin-first. Self-sovereignty. Privacy.

Our ideals, so clearly manifest in what we've built, contrast starkly with events over the last two years.

In the recent past, Bitcoin holders have mainly earned a return on their bitcoin in two ways:

- lending bitcoin to a centralized “bitcoin bank” (e.g. Blockfi, Celsius, FTX, Nexo)

- “wrapping” bitcoin to access yield opportunities on different blockchains (e.g. lending and yield farming on Ethereum through WBTC)

Many have suffered enormous losses for trusting yield-generating services. The centralized exchanges mismanaged risk and lost customer funds. FTX apparently sold its customers' bitcoin to inflate the value of the tokens they printed from their own ears.

Many have also realized that wrapped bitcoin isn't bitcoin. No matter how the wrapping works behind the scenes, users exchange their bitcoin for a bitcoin IOU. Risk compounds. IOU redemption might fail—see, for example, the recent case of wrapped bitcoin on Solana. And yield-generating smart contracts have often suffered bugs and exploits. In addition, the wizards behind the curtain of "DeFi" have more than once pulled rugs out from underneath their users' feet.

These mishaps have inspired a flight to safety and a return to the core cypherpunk ideals of self-sovereignty and privacy. Atomic.Finance is here for the same reasons. Our users must hold their private keys. It's mandatory. But, at the same time, users can generate returns on their bitcoin, in bitcoin. No custodians, no clowns.

With Atomic, you can use our trading system while retaining your private keys. So you can earn a return on your bitcoin, in bitcoin, through automated trading without custodians. This might sound impossible. But it's real and works like a non-custodial trading bot. We'd like to explain how it works for a few reasons.

We've created something genuinely new that benefits bitcoin holders. We call them recurring strategies. We want to spread the word because recurring strategies align our incentives with bitcoin holders, especially those who hold for the long term. We benefit in the long term if and only if our users benefit in the long term. As a result, transparency about potential risks and benefits is mutually beneficial.

We'll cover this ground across a three-part series.

In this first installment, we introduce two core concepts: bitcoin covered calls and discreet log contracts. You can use our app without knowing about either, much like automobile drivers needn't know the physics of combustion engines or hydraulic braking. You can, like most, just drive. But knowing about both covered calls and DLCs is key to understanding where Atomic returns come from, as well as the associated risks and benefits.

To that end, let's pop the hood.

II. Bitcoin Covered Calls

Thanks to Thaddeus Dryja's breakthrough of discreet log contracts in 2017, non-custodial returns are not only possible but real. Discreet log contracts, or DLCs, pair bitcoin's security with more flexible smart contracts. They're flexible enough to enable financial derivatives like call and put options to settle on-chain.

One traditional call option strategy, the covered call, generates income on an asset you own. By pairing covered calls with DLCs, you can earn income on your bitcoin without entrusting your bitcoin to a custodian or exchanging it for a wrapped IOU on another network. DLC-powered covered calls are a key ingredient to our main product. To explain how they work, let's set aside DLCs temporarily and focus exclusively on covered calls. Remember, though, that users needn't know anything about covered calls. Covered calls happen under the hood.

Selling covered calls is a simple and effective option strategy to generate income on an asset. When you sell a bitcoin covered call, you receive a premium—i.e., some income—for agreeing to keep only the amount of bitcoin whose value is at or below a certain price (the strike) at some later date (the expiry). So the income generated by a covered call strategy comes at a price — potentially lost upside. If the price of bitcoin overshoots the agreed upon strike price, you will be forced to sell some of your bitcoin at that price.

Your income, then, is what your counteryparty pays for the chance to buy your bitcoin if its price exceeds the strike at expiry. For this reason, covered calls require some calculation about the probability that the strike price will be met within a given time frame. A counterparty will pay you more for the contract to the extent that they think the asset's price will exceed the strike price. Conversely, a counterparty will pay you less for a contract to the extent that they think the asset's price will stay below the strike price.

An example will make this all concrete.

An Example Contract

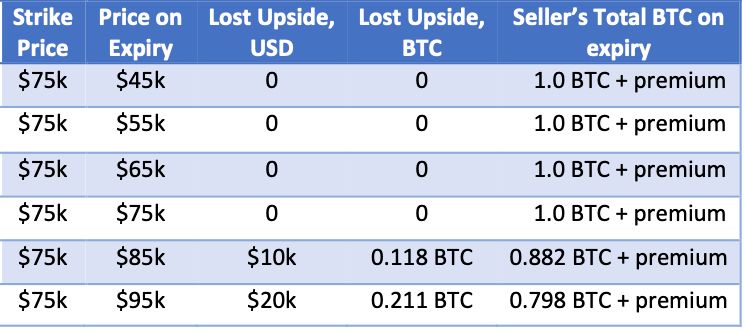

Suppose the current price is $50k per BTC. You sell a covered call on 1 BTC with an expiry two weeks from now and a strike price of $75k per BTC.

As long as the market price of BTC on expiry in two weeks is at or below $75k, you keep the whole underlying bitcoin plus the premium. But if the market price of BTC exceeds $75k, you keep only the amount of bitcoin whose value equals $75k, plus the premium. So, in exchange for the premium, the seller of a covered call sells bitcoin's potential upside. This table illustrates what this means in practice.

Not all the outcomes above are equally probable, of course. There are also well-known equations for calculating these probabilities. Our users don't need to know about them because, as we explain in Part 3 of this series, we automate the selling of covered calls behind the scenes.

Pros and cons of bitcoin covered calls

On the pro side, selling a covered call is an especially good idea when you want to sell bitcoin at a certain price anyway. In this case, you generate income on your bitcoin until it hits your sell price. Selling covered calls can also work well if you'd like to sell the potential upside beyond a price that bitcoin is unlikely to reach within some time frame. Note, however, that like any other forms of bitcoin returns, your returns may be subject to taxes.

On the con side, selling a covered call sacrifices the upside beyond the strike. The more that the bitcoin price overshoots the strike price, the less bitcoin you have when the contract settles. This is price risk.

There's one more notch on the pro side, especially compared to popular alternatives. The yield from bitcoin banks comes with counterparty risk, which is often unclear and impossible to assess. But by using bitcoin covered calls with discreet log contracts, as Atomic does, users enjoy transparency over their bitcoin and never give up custody to a third party. With DLCs, our users avoid counterparty risk and instead bear price risk.

Let's look at DLCs a bit more closely.

III. Bitcoin Finance with DLCs

DLCs were discovered in 2017 by Thaddeus (Tadge) Dryja (also co-author of the original Lightning Network paper). Since then, teams at Suredbits and Crypto Garage have contributed to advancing DLCs. DLCs bring smart contract functionality to Bitcoin, opening up a world of potential applications.

Atomic.Finance brings covered calls and DLCs together so that you can earn a return on your bitcoin without entrusting custody to a third party.

In practice, you can deposit bitcoin into your Atomic (non-custodial) wallet, then opt-in to a strategy, a month-long DLC. During the month, your bitcoin serves as the underlying asset in potentially many covered calls. But the trading is automated through the DLC depending on market conditions. So by pairing DLCs and covered calls together, our users can enjoy something like a more secure and non-custodial trading bot. Users opt-in to the strategy on a monthy basis. This is what makes the strategies recurring.

In Part 2 of this series, we explain the benefits of an automated trading system such as ours. Then, in Part 3, we explain how DLCs enable such a system.

In this process, you keep both your private keys and personal information. We should also note that unlike Ethereum and other networks which put the entire smart contract on their ledgers, DLCs enable us to keep most of the smart contract off the ledger. This greatly limits the on-chain footprint of smart contracts, overall.

In addition to the price risk of covered calls, the DLCs that encode them are dependent on the reliability of oracles. We explain DLCs more exhaustively and review oracle risks and mitigation options in A Layperson's Guide to Discreet Log Contracts.

IV. Conclusion

Atomic.Finance is blazing a new path by building Sound Finance on Sound Money — finance that makes user privacy and self-sovereignty not just possible, but mandatory. You can read more about our mission in our Sound Finance Manifesto.

We empower bitcoin holders to generate returns on their bitcoin without custodians and through an automated trading system powered by DLCs. This is just the first step in our vision to build an ecosystem of Sound Finance tools.

Join the Sound Finance Movement

Atomic Finance builds sound finance products for sound money.

Our first Sound Finance product is a mobile app that provides self-sovereign Bitcoiners a way to earn a return on their bitcoin with full transparency. Without having to give up custody of their coins to a third-party custodian.

More information on discreet log contracts

-

Thaddeus Dryja (2017) whitepaper

-

Thaddeus Dryja (2020) Labitconf presentation

-

Suredbits blog post series

-

Nadav Kohen, Stephan Livera Interview

-

Craig Warmke, A Layperson's Guide to Discreet Log Contracts

More information on covered calls

-

Lyn Alden on covered calls

-

Dan Held on bitcoin yield strategies

-

Investopedia on covered calls