Update: This post was originally published in the fall of 2020 when we first decided to make our pivot from ETH DeFi to Bitcoin-native finance. Our first product under this direction was Atomic Odds, before shifting to the Bitcoin-native returns product we're currently building. We've decided to keep this post up and update it as it communicates the story how we pivoted from ETH DeFi.

In every company's history, there comes a time when they hit an important cross-roads. For Apple, it was their 2010 decision of whether or not to continue supporting Flash. For Slack, their 2012 decision of whether or not to pivot to a chat app for co-workers from creating a browser multiplayer game. For Atomic Loans, the decision this August was whether we were going to continue building on Ethereum, or focus solely on Bitcoin.

But how did we get to this point? What prompted us to ask these tough questions? And of course, why did we make the decision that we did?

Going back to first principles.

Why did we start Atomic in the first place?

We started Atomic because of a simple belief that sound money deserves sound financial infrastructure. Infrastructure that will stand the test of time, and be around for as long as Bitcoin is around. Infrastructure that shares as much of the same assurances (being verifiable, pseudo-anonymous, borderless, censorship- and seizure-resistant, and of course, maintains Bitcoin's sacred 21M supply cap). Infrastructure that would allow Bitcoin holders to be their own banks. In building this sound financial infrastructure, we hoped to advance the Bitcoin ecosystem as a whole. We hoped to enable even greater Bitcoin adoption and accelerate Bitcoin's transition to being a world reserve asset.

The reality is, nearly all financial tools and infrastructure for Bitcoin today do not share the same assurances as Bitcoin. Many existing Bitcoin financial solutions require you to convert your Bitcoin to a Bitcoin IOU, a contractual promise that they can return your Bitcoin in the future granted that things go according to plan. A contractual promise with none of Bitcoin's original assurances.

If this trend doesn't change, then we stand at risk of a future for Bitcoin that is dominated by large centralized institutions, and crypto banks. A future where nearly every Bitcoin transaction or financial activity is done on a custodial banking layer – again, without any of the assurances that define Bitcoin.

Just as Bitcoin leveraged code to remove the need for trust in humans to guide monetary policy, we want to do the same with financial tools. The more parts of a system we can relegate to code and not humans, the more robust that system is.

ETH DeFi - A Jenga tower in disguise?

Our previous cross-chain approach wasn't doing justice to our vision of sound financial infrastructure on sound money. It was doing the opposite — taking sound money and slapping unsound financial infrastructure on top, bringing it into the Jenga tower that is ETH DeFi. Continuing to build in the ETH DeFi space would've likely forced us to launch our own token in order to compete — and there’s nothing that screams unsound money and unsound financial infrastructure than the rampant printing of money.

Getting rich quick was not why we're here. Degenerate finance was not the kind of DeFi we signed up for. And ETH/stablecoin whales shifting capital from one opportunity to the next is certainly not where we intend to focus as our addressable market in the long run.

The high time preference thinking that Ethereum projects seem to follow — launch a token now, maximize the liquidity we get on the platform, without really considering the long term ramifications on the product and the community — that did not align with our own beliefs.

The Jenga tower nature of ETH DeFi - attributed to not just a lack of care from developers but also the inherent security risks of developing with Solidity itself — that did not align with our standards for security.

And of course, the uncertainty of ETH's future as a blockchain, ridiculously high gas fees, and its dubious transition from ETH 1 to ETH 2 — that did not seem to be a good foundation on which to build sound financial infrastructure for sound money.

2/2

— Chris Blec (@ChrisBlec) September 4, 2020

Today's average gas price is 250 gwei.

6x is 1500 gwei.

That's 20x the "elevated" gas level that made liquidations unprofitable on Black Thurs.

If another Black Thursday happened now, DeFi would quickly face some absolutely existential issues.

Just imagine a bug like this bringing down mainnet. ETH 2.0 is going to need all the testing it can get. Maybe a couple of Hail Mary's too. 18 months TM. https://t.co/6e1oQ7uVYu

— Eli Afram (@justicemate) August 20, 2020

If Bitcoin has taught us one thing, it's the importance of low time-preference decision-making. The importance of building long-lasting infrastructure and products with legitimate use cases that are sustainable over the long-term. Building on ETH and printing a token for the sake of incentivizing short-term liquidity in zero-sum Ponzi schemes — that certainly was not the way we wanted to go about building sound financial infrastructure for sound money over the long run.

A Bitcoin-native approach to building future products.

As we went on, it became abundantly clear to us that Ethereum was just not a suitable foundation on which to build sound financial infrastructure for sound money. In light of this, we embarked on a journey entailing a close examination of the tools being built on Bitcoin. Would there be a way to build sound financial infrastructure natively on the soundest money known to mankind?

Being former "Ethereans" ourselves, we felt that common perception in the Ethereum space prefers to paint Bitcoin as some antiquated technology with little to no developer activity, whose primary value proposition is being stored as pet rocks by a group of close-minded maximalists in cold storage.

Our period of exploration yielded surprising results — it turns out there were a lot more projects and developer infrastructure being built on Bitcoin than we originally thought. There were a couple of highlights:

- DLC's (Discreet Log Contracts) - Bitcoin oracle contracts, being pioneered by SuredBits and CryptoGarage, that will enable binary and standard options.

- RGB (still under development) - A layer on top of Lightning Network that will allow for the issuing of assets and additional expressivity for smart contracting on Lightning.

- Bitcoin Escrow Contracts (also still in development) to allow for open ended margin positions.

- And of course, Lightning Network itself. Lightning took a giant step forward with Wumbo being recently released to enable larger channel sizes. Additionally, there are many more exciting tools in the pipeline being worked on that will allow new financial tools to be built a lot more easily on Lightning.

While we'll leave more detailed thoughts on these exciting projects for a later blog, one thing that was clear to us was that there was clear developer excitement for building on Bitcoin. In particular, for Bitcoin-Native and Lightning financial tools (LiFi). What was also clear was that while there are plenty of infrastructure builders in Bitcoin, user-friendly financial products that the average Bitcoiner could actually use were far and few between, outside of centralized and custodial products. With our knowledge of Bitcoin development, combined with our passion for user-centric product development and design, this is a niche that we at Atomic felt that we have the right expertise and aptitude to pursue.

Moving forward, we want to build non-custodial finance the right way and on the right asset — natively on Bitcoin. It won't be an easy road ahead, but boy, are we excited!

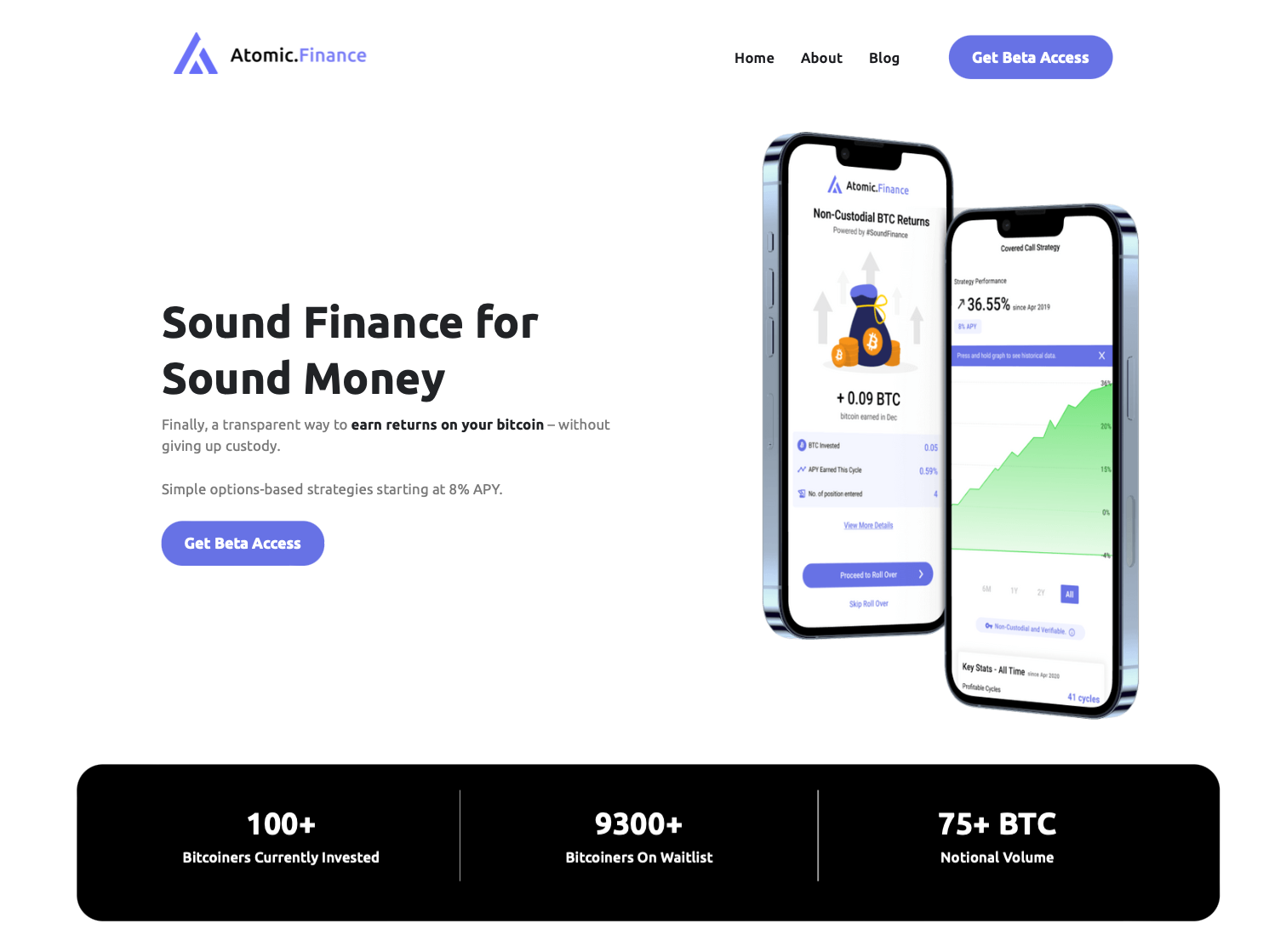

Enter Atomic.Finance

As we embark on our long term vision of enabling financial tools for Bitcoin that retain as many properties of Bitcoin as possible, it became clear that Atomic Loans was no longer a suitable name for our company. Simply put, it fails to encapsulate the wide-ranging Bitcoin-native financial ecosystem that we will work to bring to fruition.

Earn a return on your bitcoin, through the power of Discreet Log Contracts (DLC's)

In the past months, we've been working hand-in-hand with our earliest community members to build and iterate on our first major product release, Atomic.Finance. By using DLC oracle infrastructure and automated options-based strategies, Atomic.Finance is a mobile app that allows you to transparently earn a return on your bitcoin. Without ever giving custody away to a third-party custodian.

We're psyched about non-custodial Bitcoin-native finance and this product is just the start. It's what we hope to be the first of a long roadmap of self-sovereign Bitcoin-native financial tools that will share as many of Bitcoin's assurances as possible.

And we'd love for you to join us on this journey.

We've written a detailed three-part series illustrating how the product works here.

Join the Sound Finance Movement

Atomic Finance builds sound finance products for sound money.

Our first Sound Finance product is a mobile app that provides self-sovereign Bitcoiners a way to earn a return on their bitcoin with full transparency. Without having to give up custody of their coins to a third-party custodian.