For the other parts of the series, see Part 1 and Part 3.

I. Introduction

In a better world, I would have bought bitcoin in March 2020, sold it in November 2021, and then re-bought bitcoin in November 2022. I could have quadrupled my holdings in just three trades.

This iterated buy-low/sell-high strategy obviously outperforms the pure hodl strategy. But, for most, it’s unrealistic. I and many others lack the skill to predict market tops and bottoms reliably. Without skill, I'd have to rely on luck. I might as well gamble. Unskilled trading is, after all, a form of gambling.

If I have to choose between gambling with bitcoin or hodling for a 0% return in bitcoin terms, I’d choose to hodl, no question. But there’s another option—investing skillfully with less than all my bitcoin for the long term and for a modest return. By investing bitcoin skillfully, we can earn a modest return on bitcoin, in bitcoin, without gambling.

There's more than one way to do this. But Atomic's is unique. It involves a back-tested and automated trading system. We handle the trading system, and you hold the keys to your bitcoin while it trades.

There are good reasons to use a trading system, especially someone else's.

II. Trading Systems

Every trader uses rules. But not every trader uses a system. Anytime you pull the trigger on a trade for a reason, you use a rule—such-and-such conditions have been met, therefore I’m executing this trade. But you might never use this rule again—and you might have developed the rule on the spot, in the heat of the moment. Rules are cheap. We can use and discard them on a whim. We may not even think of ourselves as using rules at all.

What we need is a method for finding and honing trading rules. Such a method will have meta-rules—rules for developing and fine-tuning trading rules. Here are some good meta-rules:

Meta-Rule 1. Use data to formulate trading rules more likely to succeed.

This commits a trader to data-dependence. Because bitcoin has been highly volatile throughout its history, it's imperative that rules have already been tested against past changes in the market and through times of both high and low volatility.

Meta-Rule 2. Commit to those rules.

Commitment fosters discipline. Committing to data-driven rules means that the trader buys when the rule says to buy and sells when the rule says to sell even when emotions suggest otherwise. Because traders will have extrapolated trading rules from statistical inference, they expect some trades to lose. That’s okay—reliable traders judge the system’s performance over longer time frames.

Meta-Rule 3. Evaluate past performance.

Assessing one's own successes and failures brings accountability. We like to ignore our failures. Or, if we don't totally ignore them, we like to make excuses. To improve, traders must evaluate their past decisions harshly and with full sobriety. Doing so provides more data for traders to adjust their rules, which is what they do next:

Meta-Rule 4. Repeat Meta-Rule 1.

This feedback loop enables trading systems to improve as rules gain a track record and data rolls in about evolving market conditions.

A trading system pairs the above meta-rules with particular trading rules about when to buy and sell. With such a system, we can engage in systematic trading. Without such a system, you might still use first-order trading rules. But you’ll lack the scientific rigor, discipline, and accountability that we find among systematic traders. In such a situation, we’re especially vulnerable to various cognitive biases. We’ll call this chaotic trading.

So we have both systematic and chaotic trading. Systematic trading is a kind of science. Systematic traders rely on empirical data to formulate predictive rules about what will work. As new evidence rolls in about past performance, they update and modify their rules. If we want to take conservative risk and use our bitcoin with skill, systematic trading deserves a closer look.

III. Active vs. Passive Trading

Even if we’d prefer to trade, we may not have the time, resources, and skills to do it. If you don’t already know how to trade, you’d have to learn how. Success is by no means guaranteed, and you would have to compete against experts who likely have more resources at their disposal.

To give yourself a shot, you would need to formulate a trading system with data-driven rules—ideally, rules tested against large data sets. This takes time and skill, too. If you don’t already know how to gather and analyze data, you’d need to learn. Then, after you begin to trade, you’ll need more time time to manage your portfolio, assess your performance, and modify your rules, if necessary.

If you do all this, you might see out-sized returns. But more likely than not, you would fail to outperform the multi-billion dollar institutions stacked with professionals and powerful computers. At this point, active trading—i.e., doing it yourself—doesn’t look so appetizing. The return likely isn't worth the effort.

But some succeed with modest returns. They have the knowledge and resources to pull it off. So wouldn’t it be great if you could outsource your trading to them? For a small fee, you could reap their rewards without having to commit your own time and resources. They would find the rules and apply them to your bitcoin—and you would get most of the benefit. Instead of active trading, we could trade passively by letting someone else do it for us.

As with many jobs that require skill, the winning formula is to outsource the job to an expert. This is something that many of us already do. For example, several popular Exchange Traded Funds (ETFs) available on the stock market have traders and investors who pick stocks for you behind the scenes. Many of them under-perform the overall market, of course. But many provide sustainable returns, too. The main point is that investing our funds with an active trader isn't a new idea.

The new idea, rather, is that you and I can invest bitcoin into a conservative trading system without relinquishing full custody. Allow us to explain.

IV. Outsourcing to Experts

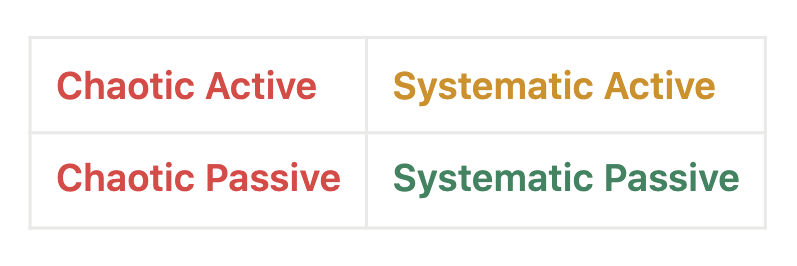

Let’s put the last two sections together. We have two possible trading practices (chaotic vs. systematic) with which we can play a more or less active role (passive vs. active). The two choices make for a nice 2 x 2 matrix:

We’ve already ruled out non-systematic trading—chaotic trading—as a fool’s errand. So the main choice is whether, if we trade at all, we should outsource the trading to an expert or do it ourselves. For most of us, the clear choice is to employ a trusted expert's trading system.

At this point, many bitcoin enthusiasts wince! Even if we trust the expert’s trading system, we don’t necessarily trust the expert to trade with our bitcoin. Giving up custody of bitcoin for a modest return simply isn’t worth the counterparty risk. Just think of all the people who have lost their coins over the last year with a trusted custodian.

Some centralized services allow users to employ a trading bot. It might be very successful—but to reap the benefits you have to deposit your bitcoin into the service’s hands. At this point, bitcoin enthusiasts wince once more. Even if we trust the rules of the trading system itself, we don’t necessarily trust their security practices. And for good reason. Many would reasonably refuse to accept this counterparty risk, no matter the return, especially after the complete and utter devastation of several centralized services through the past year.

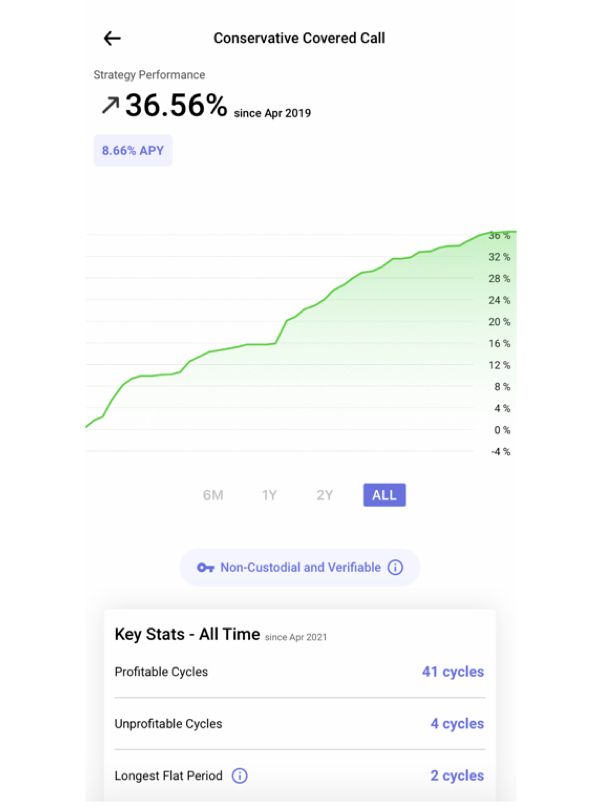

Atomic.Finance has designed an another avenue for bitcoin returns—systematic and passive trading without relinquishing full custody. In fact, since the trading is rule-based, passive, and designed to succeed over longer time frames, it looks more like investing than like trading. Bitcoiners can retain their private keys as they enjoy passive returns from Atomic's own back-tested and conservative trading system.

This is sound finance for sound money. There's no need to bridge bitcoin into the minefield of "decentralized" finance or relinquish full custody to the world of centralized finance. And it's open to everyone in the world.

This is possible through an innovation we call Subscription DLCs. The 'DLC' stands for discreet log contracts, which permit users to retain their financial sovereignty as they engage in more complex smart contracts on bitcoin’s blockchain. If you don’t know much about them, we've written a full explainer here. Subscription DLCs have a number of benefits and make some important tradeoffs. In Part 3 of the series, we explain how Subscription DLCs power recurring strategies, what their tradeoffs are, and why you might like them.

Join the Sound Finance Movement

Atomic Finance builds sound finance products for sound money.

Our first Sound Finance product is a mobile app that provides self-sovereign Bitcoiners a way to earn a return on their bitcoin with full transparency. Without having to give up custody of their coins to a third-party custodian.